Biden piles the Pressure

Hi this is ZipLaw, your go-to newsletter that’s like finding money in your old pants — it brightens your day and makes everything better.

Coming up:

🇺🇸 Biden boosts Chinese tariffs

🌴 Love islanders in FCA trouble

💸 US companies like Europe

🤖 Big week for Linklaters

Buy American

Biden does not want Americans to buy Chinese EVs. So how does he stop them? Well, he pumps up tariffs on Chinese EVs from 25% to 100%.

Result: Chinese EVs get expensive, and US ones suddenly look more attractive.

- The Biden administration's planned tariff increase to 100% on Chinese electric vehicle imports means that any EVs entering the U.S. from China will now face a significantly higher tax at the border.

- The drastic increase in tariffs reflects growing concerns that cheaper Chinese EVs could flood the U.S. market, undermining American automakers.

💡 Did you know? A tariff is a tax or duty imposed by a government on imported goods, aimed at making foreign products more expensive to encourage consumers to buy domestic alternatives.

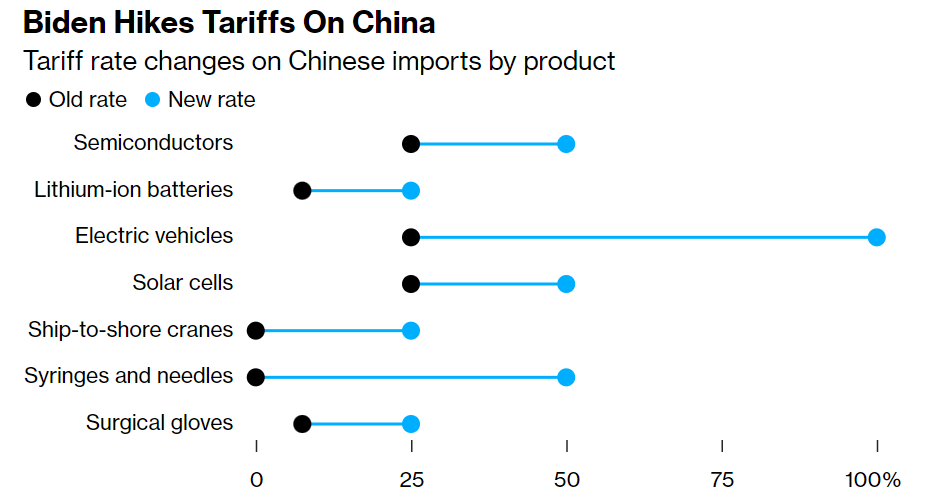

And it's not just EVs that are getting hit. Biden is eyeing up all sorts of goods as he tries to boost US producers.

Another key increase to watch out for is the one on semiconductors which will double from 25% to 50% by 2025. Semiconductors have become super valuable in recent years and have gone hyperbolic since the AI boom. The tariff increase aims to:

- Target an industry Biden has made a centrepiece of his manufacturing agenda through billions in subsidies to bolster US production

- Counter China’s rush into so-called legacy chips, older-generation components still essential to the global economy.

What happened this week?

- 🌴 The Financial Conduct Authority (FCA) charged former reality TV stars for promoting an unauthorised financial trading scheme on Instagram.

- 🇨🇳 China is contemplating a major initiative where local governments would purchase millions of unsold homes to rescue its struggling property market.

- 👗 Fashion giant Shein is leaning towards a London IPO because of the ongoing geopolitical soap opera between the US and China.

- ⛏️ Anglo American's Split: Anglo American plans to fend off BHP’s £34bn takeover bid by breaking up its business. They’ll divest coking coal and spin off platinum and diamond divisions, focusing on copper, iron ore, and crop nutrients. South Africa’s government will have a say.

- 🤖 AI Race Heats Up: OpenAI upgraded to GPT-4O, enabling voice-command conversations. Alphabet introduced Project Astra, another voice-responsive AI assistant. The AI services competition is getting fierce.

- 🤖 Reddit AI deal: OpenAI has struck a deal with Reddit to use its data for training AI models, promising new AI-powered features for Reddit users.

Follow the money (in Europe)

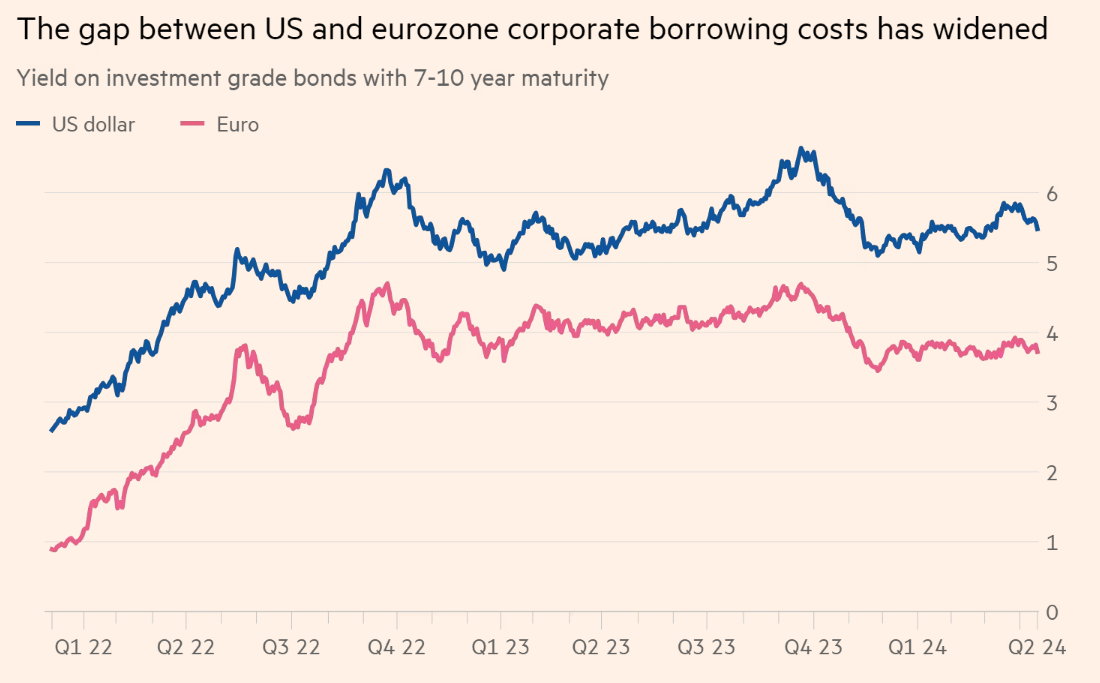

Europe is becoming very interesting for US companies as they look to raise a whopping €85 billion this year.

Why? Two big reasons: lower interest rates and a flurry of cross-border M&As.

- Big names like Johnson & Johnson and Booking Holdings are diving in headfirst, grabbing euros while the getting’s good.

- Investors are betting that the European Central Bank (ECB) will start cutting interest rates before the US Federal Reserve does, making European debt much cheaper. We’re talking almost 2 percentage points cheaper than in the US.

US companies are using so-called "reverse Yankee" deals to issue bonds in euros instead of dollars. Think of it as borrowing money in euros because it’s cheaper and more attractive right now.

In Law Firm Land...

Exciting week for Linklaters as they first advised Raspberry Pi, a company famous for its affordable single-board computers, as it announced plans to list on the London Stock Exchange. The Cambridge-based company has sold over 60 million units since 2012.

The magic circle firm then also outlined its growing focus on AI technology via its own chatbot, Laila, which is now answering nearly 30,000 questions a week. With AI handling the mundane tasks, lawyers can focus on the juicy, complex cases, making clients super happy and probably boosting those billable hours.

In other Law Firm news:

- Hogan Lovells advised Red Bull on protecting its famous "Gives You Wings trade mark"

- Baker McKenzie lead on multi-million pension deal.

- Slaughter and May and Linklaters have been advising on the Anglo American-BHP deal discussions. Latest news is Anglo decided to spin off its diamond, platinum and coal assets in a corporate restructuring aimed at boosting value for shareholders after rejecting BHP's revised offer.

⭐ Want more deals and cases featuring your favourite law firms? Check out our ZipTracker database with over 300+ cases, deals and how to discuss them in applications and interviews.

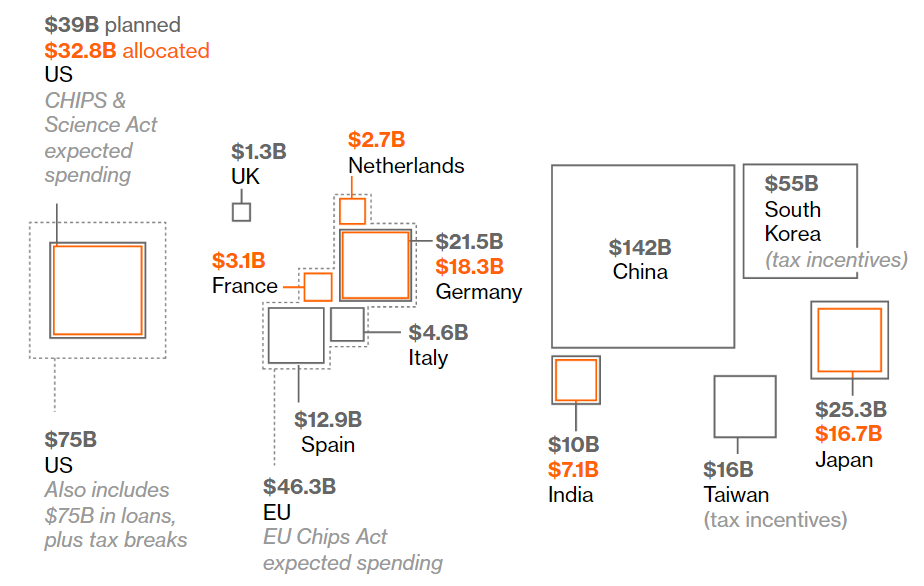

📊 Chart Watch

Chip Wars rage on

If you've been with us for a while you'll know we love chips (both the fried and the techy kind). So here's a chart on which countries are winning the chip race.

Superpowers, led by the US and the European Union, are pouring nearly $81 billion into developing the next wave of semiconductors, cranking up the heat in the global race for chip dominance against China.

It’s like an epic tech showdown, where the US and EU are bulk-buying the latest gadgets to stay ahead of China's shopping spree. This massive investment has taken the Washington-Beijing rivalry to a crucial stage, one that’s set to shape the future of the world economy. Buckle up, because this chip war is about to get electrifying!

- In other chart news, we got some good inflation data around the world this week with both the US and Europe stats meeting economist expectations. It's probably too soon to celebrate but it's definitely a step in the right direction.

👀 ZIPMEMES

Don't forget...

🙏 Our work is reader-supported. You can get a membership for cheap!

🎥 Follow us on Instagram here or TikTok here.

📫 Forward this to a friend and tell them to subscribe (hint: it's here)