Can Blockchain solve Switzerland's Banking problems?

In Short: Amidst financial shake-ups, Switzerland is rolling out digital bonds and pioneering a snazzy new digital currency to redeem its financial reputation.

What's Going On?

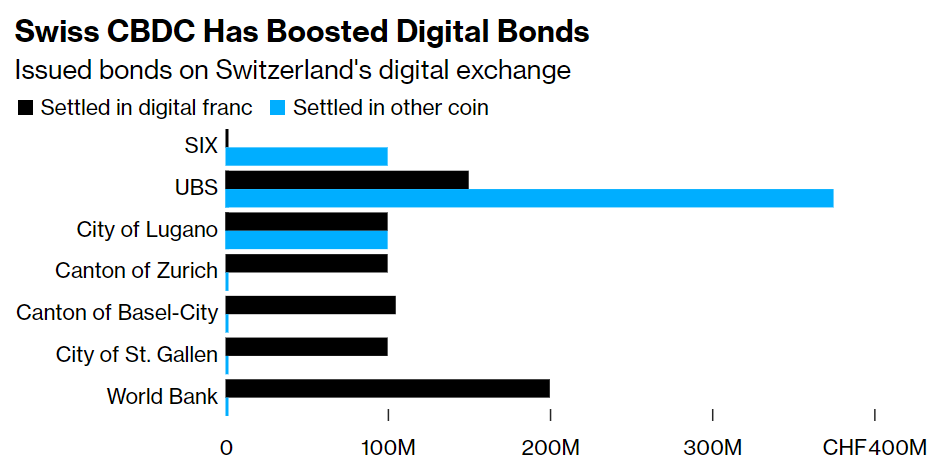

Remember the kerfuffle when Credit Suisse almost went belly up last year? Well, Switzerland didn’t just sit around twiddling their thumbs. They got busy crafting their financial comeback story. Just nine months after Credit Suisse got scooped up by UBS, places like Zurich, Basel, and Lugano began popping out these cool "tokenized bonds" using a fresh digital Swiss franc.

- Tokenized Bonds are traditional bonds converted into digital tokens. Each token represents ownership and is recorded on a blockchain, which ensures secure and transparent transactions.

The Swiss National Bank is pretty chuffed about it all, extending this experimental bash for another two years. While the rest of the world's financial bigwigs are still doodling on the drawing board, Switzerland is sprinting ahead, linking these shiny new bonds directly to their central bank digital currency.

- And what's blockchain again? Think of blockchain like a digital notebook that many people can write in, but no one can erase. Each page of the notebook contains a record of transactions, and once the community fills a page, it gets added to the notebook permanently. Everyone has a copy of this notebook, so if someone tries to cheat and change a transaction on one page, everyone else’s copy will show the cheat and reject the change.

Subscribe to continue reading