Can you Buy Greenland?

Hi ZipLawyer! Here's all the news you need to know from the past week in less than 5 minutes.

Can you Buy Greenland?

In case you missed it, Donald Trump tried to live out his inner Monopoly dreams by suggesting the US buy Greenland for "national security" reasons. Oh, and he also mulled over shutting down Canadian car exports and taking control of the Panama Canal. Denmark’s PM quickly shut down the idea, reminding everyone that Greenland isn’t for sale. No word yet on whether Trump plans to add world domination to his bucket list.

Meta changes system

Mark Zuckerberg’s latest brainwave: ditch Meta’s fact-checking system and let users do the job instead—because what could go wrong? Meta introduced fact-checking post-Trump 2016, but now they’re leaning into free speech, an approach similar to X. Meanwhile, they added bigwigs like Dana White, John Elkann, and AI expert Charlie Songhurst to their board.

Nvidia's Big Robotics Play

Nvidia’s CEO, Jensen Huang, unveiled shiny new robotics tech and a partnership with Toyota, hoping to lead the AI-driven robotics race. Cool stuff, right? Well, investors weren’t impressed—stock prices dipped as they wait to see if this gamble actually pays off. Robots may be the future, but Wall Street wants returns yesterday.

Blocked Merger, Lawsuit incoming

Nippon Steel and US Steel aren’t thrilled about Biden blocking their $1.6 billion merger. They’ve filed a lawsuit, claiming the decision was politically motivated and violated their rights. Steel unions opposed the deal, fearing national security risks. Without the merger, US Steel’s future looks… rusty.

Biden’s Last Hurrah

With his presidency wrapping up, Biden went out with a bang—banning offshore drilling along much of the US coast while keeping the Gulf of Mexico open for business. He also blacklisted Chinese firms CATL and Tencent for alleged military ties. Unsurprisingly, both companies denied it, but their stocks took a nosedive anyway.

Eurozone Inflation – Why So Pricey?

Eurozone inflation rose to 2.4% in December, driven by energy prices. Blame it on energy costs! After a brief honeymoon period of low inflation, energy prices—particularly gas and oil—started creeping up again. The European Central Bank (ECB) now has a tricky balancing act: if they raise interest rates too much, they risk slowing down economic growth or even triggering a recession. But if they don’t act, inflation could spiral out of control.

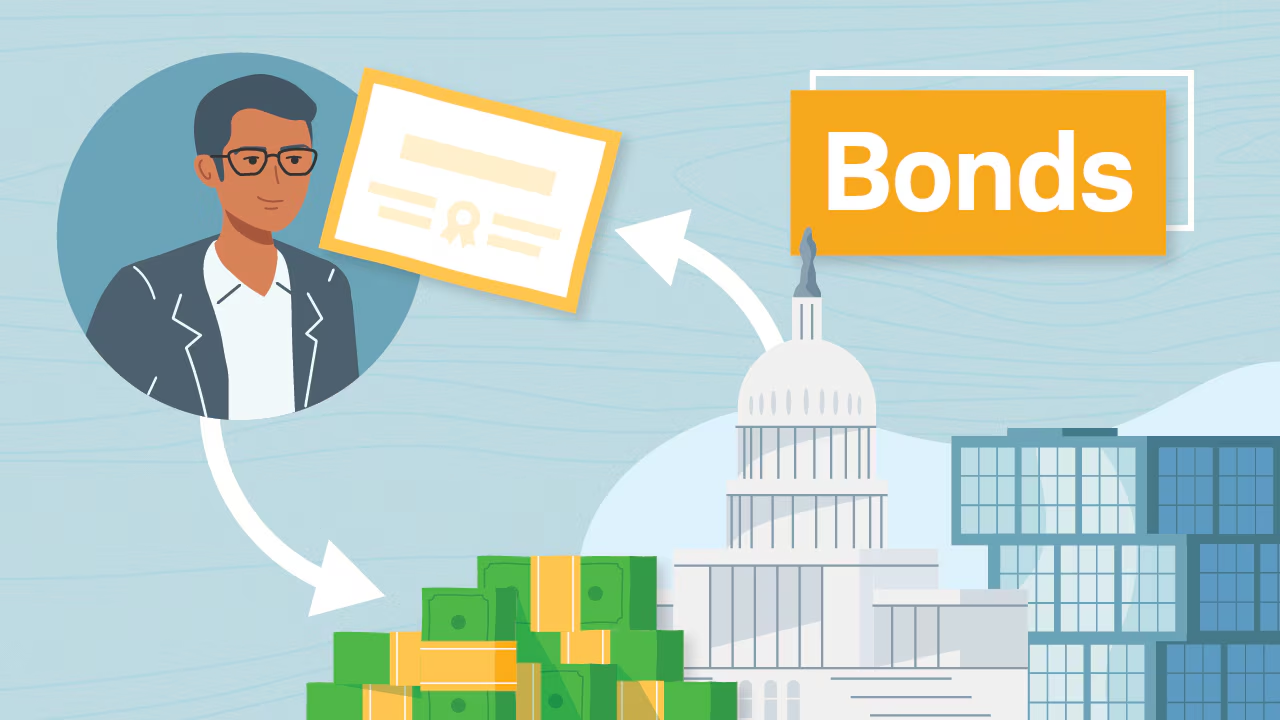

Term of the Week: Bonds

What the hell are they? Bonds are essentially IOUs issued by governments or companies to raise money, where investors lend cash in exchange for regular interest payments and the promise of full repayment at a set date.

Why is the term of the week?

The bond market kicked off the year with drama—UK government bond yields hit a 15-year high of 4.9%, while China’s fell to record lows.

- What’s behind this? Government borrowing. When governments need cash, they issue bonds. Higher UK yields mean investors see lending to a debt-laden government as riskier, so they demand more interest.

- `Why does it matter? Higher yields make borrowing pricier for everyone—governments, businesses, and people (hello, rising mortgage rates). Meanwhile, China is keeping yields low to stimulate its slowing economy by encouraging cheap borrowing.

🙋 Did you find this helpful? If so, please let us know by voting below!