Memo: Rush to Complete

Good morning ZipLawyer! Today's memo:

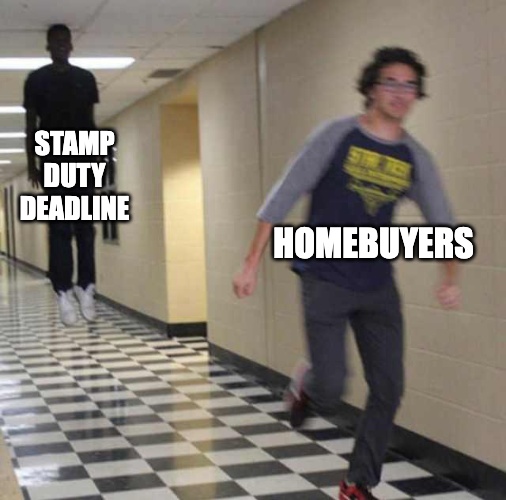

- 💸 Business: Homebuyers rush to close deals, Reeves tries to boost economy

- 👀 Week ahead: China's new plans, central banks moves

- ⚖️ Law: Tesco v Lidl case drama, Weil leads on PE deal, Lewis Silkin and Proskauer boost teams

Business News

🏠 Race to completion: Over 575,000 UK homebuyers are scrambling to close deals before April’s stamp duty tax break ends, a 21% jump from last year. Buyers are eager to avoid tax hikes of up to £11,000 extra per purchase, but with the average transaction taking five months, nearly 75,000 buyers risk missing the cut-off. Despite strong supply, high borrowing costs are keeping demand in check, and estate agents warn of a market slowdown post-deadline. In March, UK house prices crept up just 1.1%, while mortgage rates linger around 4.7%.

💸 Boost Move: Chancellor Rachel Reeves wants to jumpstart the UK’s weak economy by cutting both business regulations and welfare spending. She plans to reduce the cost of running regulators like the Payment Systems Regulator by 25%, folding some into larger bodies like the FCA. Reeves hopes cutting costs will encourage businesses to invest more. But critics warn these moves could hit low-income families hardest.

📉 Missing out: Not all defence giants are flying high—QinetiQ shares nosedived 16% after slashing its 2025 revenue outlook, citing geopolitical jitters and delays in the UK intelligence sector. The company’s also shaking up its US operations, bracing for a £140 million impairment hit by year-end.

✂️ DEI Cuts: Over 200 major US companies (90% of the top 400 in the S&P 500) have cut or removed “diversity, equity and inclusion” (DEI) mentions since Trump’s election, with many eliminating terms like “diversity” entirely. The shift coincides with Trump's criticism of DEI as “illegal and immoral”.

👀 Week Ahead

Monday: China revealed new plans to encourage people to spend more and boost its economy. In the US, we'll get data on how much people have been shopping—important because consumer spending drives the economy. Plus, a global organisation called the OECD will give its latest predictions on how the world economy is doing.

Tuesday: Canada releases its inflation numbers—basically, how much prices have gone up. Chile will report how much its economy grew or shrank over the past few months (known as GDP, or Gross Domestic Product).

Wednesday: All eyes on the big central banks. The US Federal Reserve and Japan’s central bank are both expected to keep interest rates the same, meaning borrowing costs stay steady. But Brazil’s central bank might do the opposite—raising rates by quite a lot to control inflation. Argentina will also release its GDP report, and Chinese tech giant Tencent will announce how much money it made recently.

Thursday: The UK publishes key jobs data, showing things like how many people are unemployed and how fast wages are growing. The Bank of England is expected to leave interest rates unchanged. In the US, major companies—Nike, FedEx, and Accenture—will report how much they’ve earned. Their results give clues about how confident consumers, businesses, and governments are in spending money.

Friday: Japan reports its latest inflation numbers. Meanwhile, central banks in Russia and Chile are expected to keep their interest rates steady.

Law Firm News

Subscribe to continue reading