Metal Showdown

In Short: The US and UK have introduced new sanctions that restrict the trading of Russian-produced aluminium, copper, and nickel on major exchanges, aiming to curb Russia's war funding capabilities.

What’s going on?

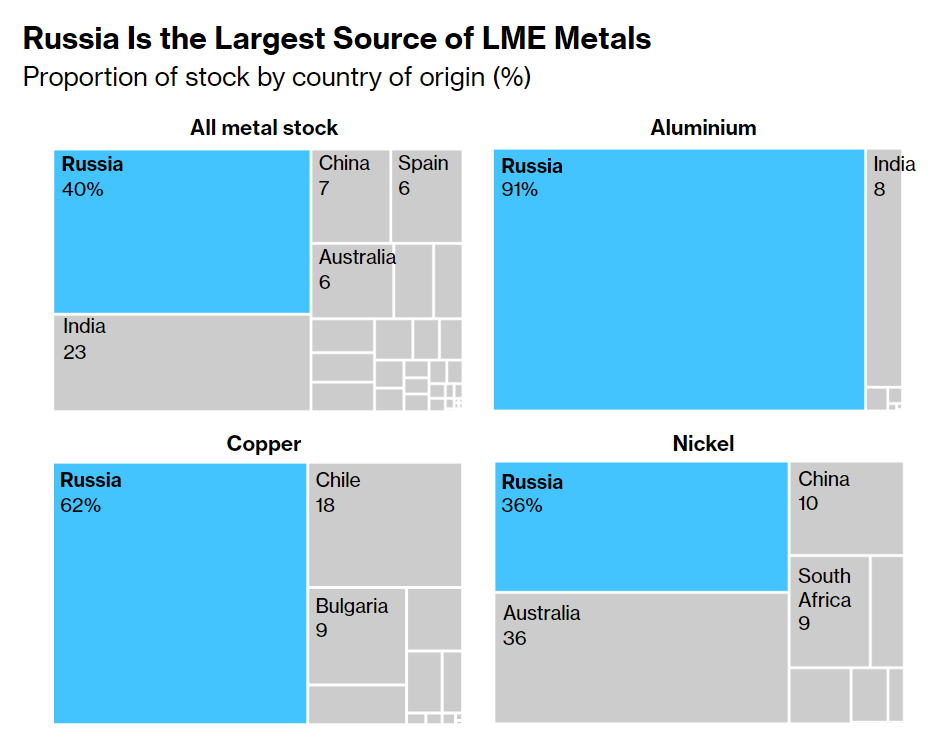

The US and UK governments have just put the brakes on Russian metals—specifically aluminium, copper, and nickel—being traded on the London Metal Exchange (LME) and Chicago Mercantile Exchange. These metals, produced after April 13, are now a no-go for direct delivery to these key market hubs.

Why focus on these exchanges? Well, the LME is like the big league where global metal prices are pitched and swung. It’s the benchmark. While Russia can still sell these metals to others (looking at you, non-US buyers), not playing on the main field means fewer buyers and potentially lower prices.

Already, Russian metal sales have been shifting towards China as Western buyers look elsewhere. Despite this, the new rules are expected to pinch the prices on the LME, where prices are a cornerstone for countless global contracts.

Why does it matter?

Metals are more than shiny things and industrial fodder. They are big money. In 2022, Russian exports of these metals raked in a cool $25 billion. These new sanctions are aimed at shrinking that wallet, thus squeezing the funds available for Russia's military activities without causing a global supply shock.

Moreover, with major players like Glencore in the spotlight for their ongoing trade with Russian firms, and the US metal producers seeing their stock prices tick up post-announcement, it's clear: the world of metals is as much about geopolitics as it is about economics. As these metals form the backbone of everything from cars to gadgets, the ripple effects of these sanctions could touch industries and markets globally, making this a development worth watching.

💡 Bonus point: Apparently metal traders have found a way round these sanctions. Might be worth knowing if you are interested in capital markets and want to mention something unique in interviews and applications.

- Selling Strategy: Traders are quickly removing Russian metal from the London Metal Exchange's storage and selling it back on the same exchange. They make deals with the warehouses to get a share of the money made from storing the metal.

- Price Spike: The traders are buying up the metal quickly, which causes the prices for immediate purchase to go higher than prices for future purchase. This signals that traders are rushing to get their hands on the metal right now.

- Profit from Storage: The traders are betting that this metal will not be bought soon because of the sanctions, so they plan to make money for as long as the metal just sits in the warehouse.

⚖️ How does this impact Law Firms?

Subscribe to continue reading