Microsoft-Activision deal gets approved?

Hi this is ZipLaw! This is our Roundup Newsletter where we run through all the top news stories of this past week and explain how they impact law firms.

Here’s what we’re serving today:

- CMA approves Microsoft-Activision deal 🎮

- US car strikes 🚗

- Asia is trading in-house 📦

- Top business trends in AI 🤖

- UK's anti-green turn 🇬🇧

- What's going on with interest rates? 💸

Are you new here? Get free emails to your inbox.

CMA approves Microsoft-Activision deal

⏱️ In Short

This is the story that keeps on giving. Microsoft's $75 billion bid to buy Activision Blizzard just got a thumbs-up from the UK's competition watchdog. So let's break it down.

What's going on?

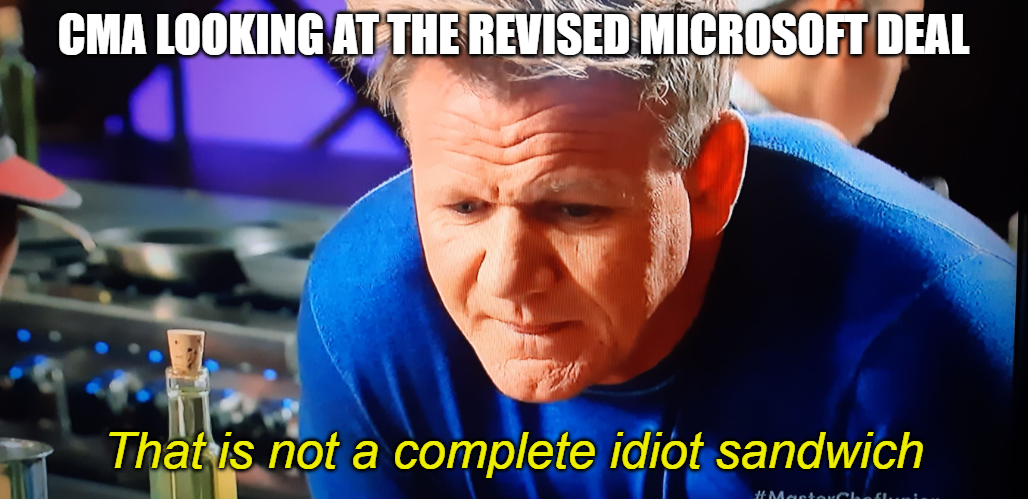

Picture Microsoft as the ambitious chef trying to create the ultimate dish by adding Activision, the exotic spice that makes everything better (think saffron with a hint of Call of Duty). But here comes the UK's Competition and Markets Authority (CMA), acting like the stern judge on a cooking show, saying, "Hold on, that recipe might just be too overpowering for the market!"

So, Microsoft and Activision go back to the drawing board—err, kitchen—and tweak their recipe to make it more digestible for the CMA's palate. And voila! The judge takes another bite and says, "Hmm, not bad. You might just be onto something here."

The Deal Sweetener: Cloud Streaming Rights

What changed the CMA's mind? Well, Microsoft agreed to sell Activision's cloud streaming rights to Ubisoft. This means Microsoft can't hog Activision's games like World of Warcraft and Diablo for its Xbox Cloud Gaming service (which is good for competition in the gaming market!). They'll have to share, like it or not.

The Clock is Ticking: What's Next?

The CMA's consultation will run until 6 October, and the deal has to close by 18 October. So, it's like the final minutes of a basketball game, and Microsoft's got the ball. They've also been making nice with other players, like Sony, to show they can play well with others. But will they score before the buzzer?

⚖️ How does this impact Law Firms?

Mergers and Acquisitions (M&A):

- Due Diligence and Contract Review: M&A lawyers will be neck-deep in due diligence, scrutinising every aspect of the proposed Microsoft-Activision deal to ensure it complies with all relevant laws and regulations. This will include a review of intellectual property rights, employee contracts, and existing litigation that could affect the merger.

- Negotiating Amendments: Given that the deal has already been modified once to appease the CMA, M&A lawyers will likely be involved in further negotiations to tweak the deal's terms. This could include renegotiating the sale of cloud streaming rights to Ubisoft or other third parties, and ensuring that these amendments are legally sound and enforceable.

Antitrust and Regulatory:

- Competition Assessment: Antitrust lawyers will be crucial in conducting further competition assessments, particularly in light of the CMA's "limited residual concerns." They'll need to ensure that Microsoft's acquisition of Activision doesn't create an unfair advantage in the gaming and cloud streaming markets.

- Regulatory Compliance and Appeals: These lawyers will also be tasked with ensuring that the deal meets the regulatory requirements not just in the UK, but also in other jurisdictions that have yet to give their approval. Additionally, they may need to prepare for potential appeals, especially given that the US Federal Trade Commission is still trying to appeal against the latest decision allowing the deal to proceed.

Intellectual Property (IP):

- Licensing Agreements: IP lawyers will have a field day drafting and reviewing licensing agreements, especially since Microsoft has committed to licensing Activision’s catalogue to other cloud streaming services. These agreements must be watertight to prevent future legal disputes.

- Protection of IP Rights: As Activision's games like Call of Duty, World of Warcraft, and Diablo are significant assets, IP lawyers will need to ensure that the intellectual property rights associated with these franchises are adequately protected post-acquisition. This could involve registering new trademarks or defending existing ones in various jurisdictions.

Asia is trading in-house

⏱️ In Short

Asia's going all "circle of trust", trading more within the continent and less with the West.

What's going on?

Remember when Iron Man, Thor, and Captain America teamed up to save the world? Well, Asian countries are doing their own version of that, but with trade. In 1990, only 46% of Asian trade was within the continent. Fast forward to 2021, and it's 58%, baby! They're sharing everything from tech components to investment dollars like they're trading Pokémon cards in the schoolyard.

When did this start?

After the 2008 financial crisis, Western banks were like, "I'm outta here!" Asian banks saw the opportunity and swooped in like Batman on a Gotham crime scene. Now, more than half of the region's overseas lending is from local banks. China's state banks are leading this charge, and Japan's not far behind.

Asia's got this

The US used to be a key power in Asia. Not anymore! In a recent survey, only 11% thought America was the most influential economic power in Asia. China's Belt and Road Initiative is the new blockbuster, but don't sleep on Japan and South Korea—they're the indie films that everyone ends up loving.

Asia's basically saying, "We got this, thanks." They're building their own supply chains, investing in each other, and basically setting up a new playground where the West isn't the cool kid anymore. And guess what? This trend is likely to speed up.

⚖️ How does this impact Law Firms?

Subscribe to continue reading