Recession Incoming?

Hi ZipLawyer! Today’s Memo:

🇬🇧 Recession Incoming?

💸 Tax Gap for HMRC

🚗 Vroom Vroom IPO

⚖️ HSF leads on investor claim

💰 Reed Smith leads on Buy Back

🙋 What is a Share Buy Back?

Recession Incoming?

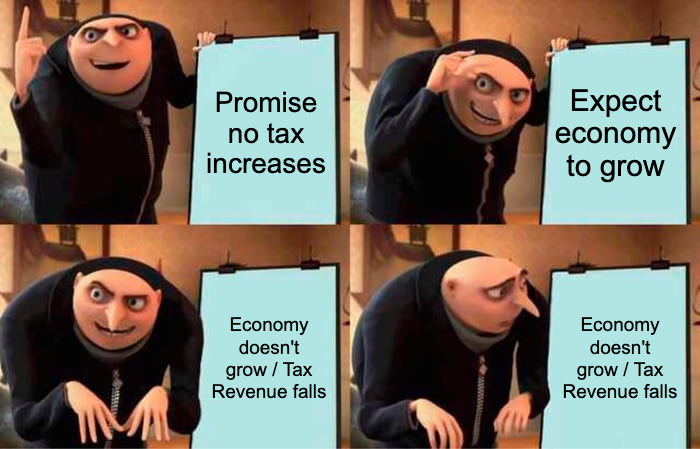

UK Chancellor Rachel Reeves may have to cut government spending after the Office for Budget Responsibility (OBR), lowered its expectations for economic growth.

Why does this matter?

- The government’s budget plan relies on the economy growing as expected—when growth slows, tax revenues are lower, making it harder to cover public spending.

- In October, Reeves had a small financial cushion of £9.9 billion to meet her key budget rule: that everyday government spending (on things like schools, hospitals, and welfare) must be covered by tax income, rather than borrowing. However, the latest forecast suggests that cushion has now disappeared, meaning there could be a budget shortfall (i.e. public spending is higher than tax revenues).

So...what now?

This leaves Reeves with difficult choices. Since she has promised not to raise taxes for now, she may have to cut spending on public services or find other ways to boost economic growth before the OBR publishes its final report on 26 March. Economic data coming out in the next few weeks could slightly improve or worsen the outlook, giving her some time to adjust her plans. However, if the numbers don’t improve, she may need to announce spending cuts to balance the books.

Tax Gap

HMRC might be seriously lowballing how much is slipping through the cracks, according to MPs on the Public Accounts Committee. HMRC pegs illegal tax avoidance losses at £5.5 billion a year, but a recent VAT crackdown suggests the real number could be way higher. Factor in fraud and errors, and the total tax gap hit £39.8 billion in 2022-23—a sum that could make Chancellor Rachel Reeves’ budget balancing act a lot trickier. With spending cuts or tax hikes looming, MPs are calling out HMRC for its lack of a clear strategy and failure to crack down hard on fraud.

Vroom Vroom IPO

CATL, the world’s EV battery heavyweight and supplier to Tesla and Volkswagen, is revving up for a $7 billion secondary listing in Hong Kong. With Chinese firms facing tight capital controls, Hong Kong is becoming the go-to offshore funding spot—despite CATL being blacklisted by the U.S. The battery giant isn’t slowing down, pushing ahead with global expansion in Hungary, Spain, and Indonesia. A successful listing could give Hong Kong’s financial hub status a jolt, but with China’s economic slowdown and geopolitical tensions in the mix, investors might not be fully charged on enthusiasm just yet.

HSF leads on investor claim

Subscribe to continue reading